Top Bikes Under 2 Lakh in India

Jun 27, 2025 | 4 mins read

Jun 27, 2025 | 4 mins read

Jun 27, 2025 | 4 mins read

Jun 26, 2025 | 4 mins read

Jun 26, 2025 | 4 mins read

Jun 26, 2025 | 4 mins read

Jun 26, 2025 | 4 mins read

May 6, 2025 | 4 mins read

Jun 12, 2025 | 4 mins read

Jun 11, 2025 | 4 mins read

Jun 10, 2025 | 4 mins read

May 16, 2025 | 4 mins watch

May 16, 2025 | 4 mins watch

May 16, 2025 | 4 mins watch

May 16, 2025 | 4 mins watch

May 16, 2025 | 4 mins watch

May 16, 2025 | 4 mins watch

Nov 23, 2024 | 4 mins watch

Nov 23, 2024 | 4 mins watch

Nov 23, 2024 | 4 mins watch

.webp)

Nov 23, 2024 | 4 mins watch

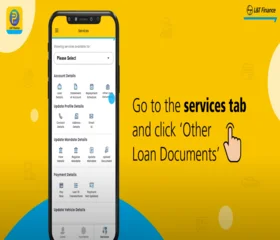

You can repay your two-wheeler loan with a range of options. This includes eNach (Net Banking, Debit Card, Aadhaar, UPI), physical mandate through direct bank transfers, online payment through L&T Finance website. You can also repay through cheque & cash by visiting your nearest L&T Finance branch.

To secure the lowest Personal Loan interest rate in India, maintain a high credit score, compare lender offers, and choose shorter loan tenures.

Yes, but you may also require basic income proof and address proof.

A high credit score typically leads to lower interest rates as it indicates low credit risk, while a low score may increase rates due to higher perceived risk by lenders.

At L&T Finance, current Personal Loan interest rates start from 11%* per annum, depending on your creditworthiness and lender.

Yes, prepayment is allowed with applicable charges.

MOD (Memorandum of Deposit) charges are fees related to depositing title deeds as security against the Home Loan.

It is a digital tool designed to estimate the foreclosure charges and savings when you repay your Loan Against Property early.

It is an online tool designed to calculate the impact of prepaying your loan, showing potential savings and tenure reduction.

Applying for a Two Wheeler Loan involves applying with the documents required for a Two Wheeler Loan application, which include identity, address, and income proof. Upon submission, the lender will verify your documents and creditworthiness before approving the loan.

Download the Planet app for a one stop loan solution with effortless management at your fingertips. Learn More

Quick Links