Understand About Types of Mortgage Loans

Jun 12, 2025 | 4 mins read

09 offersavailable

A strong payment history is crucial for building a good credit score. To maintain a healthy credit profile, continue using your older credit cards responsibly.

Prompt and consistent payments on your credit card significantly impact your credit score. Always pay your bills on time to demonstrate financial responsibility.

A low credit utilisation ratio is key to a good credit score. Keep your credit card balance well below your credit limit to improve your creditworthiness.

Jun 12, 2025 | 4 mins read

Jun 11, 2025 | 4 mins read

Jun 10, 2025 | 4 mins read

Jun 10, 2025 | 4 mins read

4296f933-3737-4ef4-ae7c-4037ed7a76b4.webp)

Jun 10, 2025 | 4 mins read

Jun 9, 2025 | 4 mins read

Jun 9, 2025 | 4 mins read

Jun 9, 2025 | 4 mins read

May 30, 2025 | 4 mins read

May 20, 2025 | 4 mins read

May 16, 2025 | 4 mins watch

May 16, 2025 | 4 mins watch

May 16, 2025 | 4 mins watch

May 16, 2025 | 4 mins watch

May 16, 2025 | 4 mins watch

May 16, 2025 | 4 mins watch

Nov 23, 2024 | 4 mins watch

Nov 23, 2024 | 4 mins watch

Nov 23, 2024 | 4 mins watch

.webp)

Nov 23, 2024 | 4 mins watch

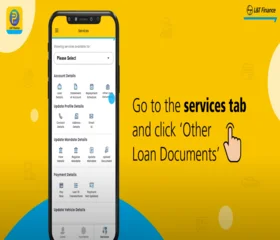

You can repay your two-wheeler loan with a range of options. This includes eNach (Net Banking, Debit Card, Aadhaar, UPI), physical mandate through direct bank transfers, online payment through L&T Finance website. You can also repay through cheque & cash by visiting your nearest L&T Finance branch.

To secure the lowest Personal Loan interest rate in India, maintain a high credit score, compare lender offers, and choose shorter loan tenures.

Yes, but you may also require basic income proof and address proof.

A high credit score typically leads to lower interest rates as it indicates low credit risk, while a low score may increase rates due to higher perceived risk by lenders.

At L&T Finance, current Personal Loan interest rates start from 11%* per annum, depending on your creditworthiness and lender.

MOD (Memorandum of Deposit) charges are fees related to depositing title deeds as security against the Home Loan.

It is a digital tool designed to estimate the foreclosure charges and savings when you repay your Loan Against Property early.

It is an online tool designed to calculate the impact of prepaying your loan, showing potential savings and tenure reduction.

Applying for a Two Wheeler Loan involves applying with the documents required for a Two Wheeler Loan application, which include identity, address, and income proof. Upon submission, the lender will verify your documents and creditworthiness before approving the loan.

Yes, you can foreclose your Kisan Suvidha Top-up Loan. However, you will be charged 2% of the outstanding principal amount plus applicable taxes.

Download the Planet app for a one stop loan and insurance solution with effortless management at your fingertips. Learn More

Quick Links